episode results

At age 72, advisors must remind clients about the Required Minimum Distributions (RMDs). With some version of this, for decades, the IRS has allowed you to defer paying taxes on your retirement accounts, but now, like the Pied Piper, they want

Welcome back to Powering Your Retirement Radio. This week we are talking about the four different Tax buckets to everyone has access to. Ordinary Income Bucket This bucket is your paycheck, regular taxable investments, rental income, and So

Welcome back to Powering Your Retirement Radio. In the episode, we will discuss the different Milestones that certain birthdays bring. 0 to 18 years - Kiddie Tax Issues 18+ - Claiming children as dependents 18 or 21, even 25 - Age of Majority

continued from the last Episode. 5. Spillover Election 6. After-Tax Contributions, regardless of income 7. BrokerageLink *Bonus Tip Visit the podcast website: https://poweringyourretirement.com/2022/08/25/401k-tune-up-tips-part-2/(o

1. Contribution Calculation Every year, when you get a raise, you automatically save a little more money. At some point, you will likely hit the 401k contribution limit. Currently, that limit is $20,500. That amount is known as your Elective De

Welcome back to Powering Your Retirement Radio. I will revisit my Roth Conversions on Sale (Episode 33). I have received several calls on the episode, and in some cases, the idea of doing a conversion did not make sense. There are a few reasons

Welcome back to Powering Your Retirement Radio. In this episode, I discuss the three items mentioned in the article at the bottom of this post. The TLDR answer is nobody knows how it will end, but it doesn't mean people won't try to predict it

Roth conversions are on sale. Let’s look at what to consider when considering a Roth conversion. If you believe we are in a downturn and the stock market will hit new all-time highs at some point, you need to consider a Roth Conversion. Topics

Welcome back. This week I talk about Digital Assets and the Fed Meeting yesterday. The show was recorded Monday so that you can hear my predictions. Spoiler alert, I didn’t do too bad. Last week I attended the Digital Assets Council of Financia

What the heck? There are so many things that make us scratch our heads when we hear how they work. In this episode, I will share with you what Filial Laws are, what the Hold Harmless provision between Social Security and Medicare is, and fina

Well, the sell of continues. When will the doom and gloom end? That is the question of the day. Welcome back to Powering Your Retirement Radio. More than 10 trillion of paper wealth has been lost since the beginning of 2022. The NASDAQ and Rus

April was a terrible month in the markets, in fact, the NASDAQ is off to the worst start to a calendar year ever! There are lots of reasons to be nervous about the markets, economy, and peace around the world. The one thing you should not lose

When can I retire? This is easily one of the most often asked questions I get? Like most things, the answer is very unsatisfying; it depends. That doesn't mean many people aren't pleased with the outcome. It is next to impossible to look at som

Here is a breakdown of the 10 themes and a link to the full report 10 investment themes for 2022 1 Pricing power 2 Tech trifecta 3 Dividend comeback 4 Health care innovation 5 Transportation transformation 6 China challenges and opportunities 7

Everyone has questions, a common one is when to claim Social Security? Last week I had an individual in asking that very question. I think this person was like many people I talk to, they wanted a definitive answer, not a word problem from the

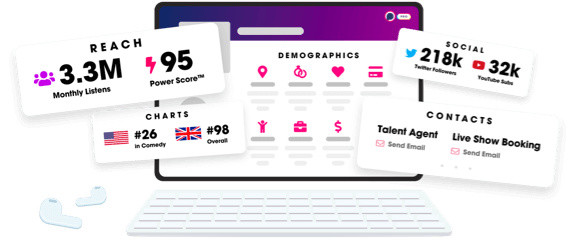

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us