EY Cross-Border Taxation Alerts

Episodes of EY Cross-Border Taxation Alerts

Mark All

A review of the week's major US international tax-related news. In this edition: IRS releases final IP repatriation regulations – Treasury and IRS will release technical corrections to CAMT regs – IRS final DCL regulations will clarify anti-av

A review of the week's major US international tax-related news. In this edition: US general election will have major impact on tax policy IRS to update draft digital asset reporting instructions for Form 1099-DA OECD issues FAQs on CARF EY re

A review of this week's major US international tax-related news. In this edition: US presidential candidates reveal tax positions – Congress averts government shutdown with continuing resolution, adjourns until after election – US officials di

A review of this week's major US international tax-related news. In this edition: US House Speaker promises “Day One” focus on corporate tax policy with Republican election sweep – IRS soon to release final Section 367(d) regs on IP repatriati

A review of this week's major US international tax-related news. In this edition: US Treasury issues proposed regulations on CAMT, extends penalty relief for failure to pay estimated CAMT – Treasury and IRS officials to evaluate narrowing scop

A review of this week's major US international tax-related news. In this edition: US Congress to return to Washington – IRS corrects proposed regs to permit foreign currency mark-to-market election to be made with returns filed after 19 August

A review of this week's major US international tax-related news. In this edition: US Tax Court rules taxpayer entitled to DRD, but limits foreign tax credit.

A review of this week's major US international tax-related news. In this edition: IRS issues new proposed regulations that limit / modify taxpayers’ FX elections – UN Committee advances Terms of Reference for convention on international tax co

A review of this week's major US international tax-related news. In this edition: US economic and tax policy become focus in Presidential race – IRS issues early draft form for brokers to report digital assets sales and exchanges – IRS expandi

A review of this week's major US international tax-related news. In this edition: US Treasury and IRS issue proposed DCL regs addressing BEPS Pillar Two, other issues.

A review of this week's major US international tax-related news. In this edition: US Congress adjourns for August recess – Senate fails to move Tax Relief for American Families and Workers Act with international provisions – G20 / Central Bank

A review of this week's major US international tax-related news. In this edition: US House begins summer recess, Senate has additional week – DC Circuit Court of Appeals reverses Tax Court; FP’s gain from inventory on US partnership dispositi

A review of this week's major US international tax-related news. In this edition: US IRS releases final Section 367(b) regs addressing cross-border triangular reorganizations, inbound nonrecognition transactions – Congress reacts to Supreme C

A review of the week's major US international tax-related news. In this edition: IRS issues procedural final regulations on stock repurchase excise tax – IRS releases final digital asset broker reporting regs, transitional relief for certain br

A review of the week's major US international tax-related news. In this edition: US Supreme Court ends court deference to agency interpretations of ambiguous laws, including tax laws – US House Republican Tax Team on global competitiveness to h

A review of the week's major US international tax-related news. In this edition: US Supreme Court upholds validity of IRC Section 965 mandatory repatriation tax – US Treasury Department suspends key provisions of US-Russia Tax Treaty and Protoc

A review of the week's major US international tax-related news. In this edition: US House Republicans eye budget reconciliation legislation in 2025 – IRS again extends penalty relief for failure to pay estimated CAMT.

A review of the week's major US international tax-related news. In this edition: US IRS officials discuss pending CAMT, stock buy-back regs – BEPS Pillar One Amount B package to be finalized soon – OECD releases updated FAQs on ICAP program.

A review of the week's major US international tax-related news. In this edition: OECD will release two more rounds of BEPS Pillar Two GloBE administrative guidance – US will not sign Pillar One MLC until India and China agree to unresolved tran

A review of the week's major US international tax-related news. In this edition: US House Ways & Means Committee launches new TCJA public comment portal – US opposes annual billionaire global wealth tax proposal – IRS notice extends Section 871

A review of the week's major US international tax-related news. In this edition: US Senate Finance Committee Chair working with Majority Leader to bring tax bill to Senate floor – CBO releases new revenue estimate on TCJA extension – White Hous

A review of the week's major US international tax-related news. In this edition: US Ways and Means Chairman says all current TCJA measures will be on the table in 2025 – Treasury official says proposed regulations on CAMT in advanced stage.

A review of the week's major US international tax-related news. In this edition: US House Ways and Means Committee hearing highlighted expiring TCJA, OECD BEPS – IRS updates rules for requesting PLRs on Section 355 transactions.

A review of the week's major US international tax-related news. In this edition: US House Ways and Means Committee hearing highlighted expiring TCJA, OECD BEPS – IRS updates rules for requesting PLRs on Section 355 transactions.

A review of the week's major US international tax-related news. In this edition: US tax policy lines being drawn ahead of 2024 election, TCJA ‘cliff’ – IRS finalizes domestically controlled qualified investment entity rules under FIRPTA – IRS p

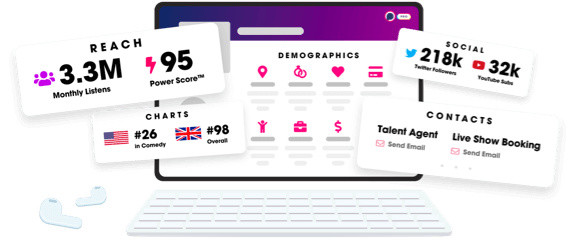

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us