Episode Transcript

Transcripts are displayed as originally observed. Some content, including advertisements may have changed.

Use Ctrl + F to search

0:05

Welcome to the show.

0:06

I'm Rashwan MacDonald, the host of Money

0:08

Making Conversations Masterclass, where

0:10

we encourage people to stop reading other people's

0:12

success stories.

0:13

And start planning their own.

0:16

Listen up as I interview entrepreneurs

0:18

from around the country, talk to celebrities

0:20

and ask them how they are running their companies,

0:23

and speak with DoD prophets who are making.

0:25

A difference in their local communities.

0:27

Now, sit back and listen as we unlock

0:29

the secrets to their success on Money

0:32

Making Conversations Masterclass.

0:34

Well, my guest today is doctor Lynn Richardson.

0:37

She is by far my most popular guest

0:39

that calls on this show. If you consider yourself

0:41

in need of advice in terms of financing,

0:44

then you are not alone. You've heard Kurt, you

0:46

heard miss Evans. She would calling about

0:48

the funnel creative and she dove open to that conversation.

0:51

You've heard my personal testimony.

0:53

It does not matter if you had just started earning

0:56

or have been earning for a long time. Every

0:58

day's a chance to reflect upon your spending

1:00

and improve your financing. Here's some

1:03

notes about doctor Lynn Richardson. Please that

1:05

the way to build wealth is to spend less

1:07

money. By implementing proper budgeting

1:10

and debt elimination strategies.

1:12

Get more money by implementing.

1:13

Wise investment strategies, and by developing

1:16

multiple streams of income including

1:18

owning a home based business. And

1:21

three, get your money back through proper

1:23

tax education. Please

1:25

welcome the Money Making Conversation Masterclass.

1:27

Again, she's a financial guru.

1:30

I call our financial genius, doctor

1:32

Lynn Richardson. Welcome back.

1:36

Well well Wealth, then, thank you so much,

1:38

rather be no place. Thank you so much,

1:41

mister McDonald.

1:42

Well, I would tell you so whenever. This show

1:44

has been on fire since

1:47

it started. You know, I had

1:49

a one person calling my bragging segment, and

1:51

he noted that he has an

1:54

app stockification

1:56

where you know, you invest third fifty

1:59

dollars a day, one hundred dollars a day, and

2:01

that the market would always correct yourself

2:03

over ten fifteen to twenty year period.

2:06

And he was saying that

2:09

that the average black person when they die

2:11

leaving wealth to a relative

2:13

is four thousand dollars. The average

2:16

white person when they die leaving wealth

2:18

is one hundred and four thousand dollars. You

2:21

have been educating us this whole process.

2:24

What is frustrated you much? Maybe not frustrated

2:26

you, but disappointed you are that you believe

2:28

that how can we as a community do

2:30

better about our financial literacy?

2:32

Doctor Lynn, you

2:34

know that's such a great question, and I would have

2:37

to say that the number one place or

2:39

the number one area that would that

2:41

frustrates me, and I would say that

2:43

to frustrate anybody is the

2:45

one area where we have absolute

2:48

one hundred percent control. You

2:50

see, we wake up every day. We have no control

2:52

over the weather. You have no control

2:54

over your friends. You have no control over your

2:56

family members. Sometimes people are

2:58

coming and going, sometimes that people are

3:00

shady, The weather is crazy, Your money

3:02

can be funny, and your change can be strange. But

3:05

the one thing we all have

3:07

control over, every last one of us,

3:09

is how much wealth we leave when

3:11

we die. And Rashan, I want

3:14

us to stop using go fund

3:16

me as a life insurance

3:19

strategy. I want us to stop using

3:21

go fund me and crowdfunding because

3:24

here's the real deal. There is one

3:26

guaranteed way to build wealth.

3:29

Because every last one of us has to do

3:31

two things. We have to pay taxes and

3:33

one day we have to leave up out of here. And

3:35

when we leave here, we have the

3:37

ability to get enough life insurance

3:40

to not just take care of our

3:42

last rights and rights of passage and the

3:44

funeral and the repasses, all

3:46

of those things, but we have the ability

3:49

to carry on wealth to future

3:51

generations. Rashan, When I was

3:53

on food stamps, I was worth

3:55

more dead than alive. I'm

3:57

not you know, that just is what it is. Most

4:00

people are anyway. But I had

4:02

enough life insurance to ensure

4:04

that my three children could graduate

4:07

from college, could live the lifestyles

4:09

that I envisioned for them. And that's

4:11

not to say that they would have just been wealthy

4:14

and footloose and fancy free. They would have had a

4:16

trust fund, and they still would have had to

4:18

work to help sustain themselves,

4:20

but they would have had enough wealth to

4:23

sustain themselves to a certain degree,

4:25

be able to continue their education, and

4:27

then pass that wealth onto their children

4:30

and their children's children. The

4:32

Bible says that a good man a good woman

4:34

leads an inheritance to a children's

4:37

children. And if I could just say anything

4:40

about spend less money, get your money

4:42

back, make your money very,

4:44

spend less money, get more money, get your money

4:46

back, I would also say make your money

4:48

grow through proper investments and

4:50

insurance is one of those investments.

4:53

You know, I have to agree,

4:56

but it's just so much though,

4:58

doctor Lenn. You you know, like

5:00

you said, the go fund me is really cute. You

5:02

know, you say, you see, I'm

5:05

trying to I'm down on my luck or

5:08

I'm struggling. If you can just put some

5:10

money in my go fund me account. You

5:12

know they're gonna take a fee when

5:14

you put it in. That's not all your money.

5:16

They're gonna take a fee a percentage of that, so

5:18

know that going in. So anytime you think

5:21

you trying to get over and think

5:23

you're getting something easy, somebody's taking a percentage

5:25

of that.

5:26

And that's what you're saying.

5:27

Do it right and establish a relationship,

5:29

whether it's an app, do your homework, or

5:32

with a small brokerage firm so

5:34

you can have a long term plan instead

5:36

of this quick get over playing.

5:38

And that's what people are doing with these go fund me accounts

5:41

because you see them on the news all the time. Immediately

5:43

after if somebody has done something or some tragedy

5:46

or a house burned down or unfortunate

5:48

death and meet quick depth in their family, the

5:50

news is always saying go fund me, set up

5:52

a go fund me. Go set up a go fund me account,

5:54

And that's not the way it goes in the real

5:57

world of trying to get your life straight financially

5:59

correct.

6:01

You know, no one has passed on

6:03

generational wealth by way of a

6:05

goalfunding me account. And what people

6:08

need to also understand is that

6:10

those gofunding accounts can be shut

6:12

down. So if there is any

6:14

yes, there's any kind of tant of

6:17

impropriety when

6:19

you set up a goal funder me account, it has

6:21

to be used for the purposes for which

6:24

it was created. And so if

6:26

the whole idea is, for example, and

6:28

we don't like to talk about death, we'll talk about

6:31

everything else. People talk about sex, they talk

6:33

about drugs, they talk about everything else, but

6:35

they don't want to talk about death. And we don't want to talk

6:37

about money. And as zig Zigglers

6:39

said, money is like oxygen. You gotta

6:41

have it. I don't care where you go, what you

6:44

do, when you look up down, all the way around,

6:46

we're gonna have to talk about money. We're

6:48

spending money every single time we go outside,

6:51

every single time we wake up, every

6:53

single time you get in your car and drive gas

6:55

money can anybody say gas money. So

6:58

we have to talk about it. And the truth

7:00

is, if we make the decision.

7:03

You see, this is a choice, Rashan,

7:05

this is a choice. I am going

7:07

to choose to spend my money on something.

7:10

For some of us, that may be furniture.

7:12

For some of us, that may be jewelry. For some

7:15

of us that may be clothing. It may

7:17

be our favorite meal. There's

7:19

one study that says, particularly as African

7:21

Americans, we are eating our wealth

7:24

away. If we just take

7:26

the money that we spend on Uber

7:29

eats, I'm just gonna throw that in there,

7:31

overeat and a limita something

7:34

over eat. If you order all

7:37

of the money that's spent

7:39

on Uber Eats and on

7:41

all of the you know, grub hub

7:44

and everything else, the delivery places

7:46

that deliver you your ten dollars Hamburger

7:49

for twenty seven dollars and twenty two cents,

7:52

if you if we take that money, the

7:55

average thirty five to

7:57

forty year old young man or young

7:59

woman could have at least a million

8:01

dollars a million dollars

8:03

in life insurance just with

8:05

your grub up money, just

8:08

with your over ease money. I didn't take away

8:10

your sandwich. I didn't take away the pizza.

8:12

I didn't take away the submarine sandwich. I didn't

8:14

take away the French fries. I said, let me

8:16

just take the delivery. Theeds that

8:19

we are spending on those things and

8:21

allocated elsewhere. So you

8:23

know that was I'm so passionate.

8:26

As you know, we're saying about so many areas

8:28

and finances and all of them require

8:30

grits, All of them require grinds.

8:33

You said it so many times, and the way

8:35

you helped others to build wealth and build their

8:37

careers. You got to stick in there. You gotta

8:39

stay in there. But life and simes you

8:42

have to just anything, just keep on living,

8:44

pay the money and then watch and see what

8:46

happens when you transition. So it's

8:48

one of those things. It's an easy win for

8:50

us as a community, an easy win.

8:52

Life insurance.

8:53

We talked about that go

8:55

fund me, stop using that,

8:58

stop using these glove HUDs apps

9:00

and all these apps and not saying it's negative, just

9:02

talking about you know, go there and

9:04

get the food versus spending the feed and

9:07

have the food brought to you. We got a call

9:09

here Michael Linn Atlanta.

9:10

How are you doing?

9:10

Michael, you're speaking to doctor Lynn Richardson on

9:13

Money Making Conversation Masterclass.

9:14

What is your question?

9:17

I'm doing absolutely fine. Thank you so much for

9:19

having me on the show. My question

9:21

actually was about life insurance. I

9:23

actually ended up losing my job not too long

9:26

ago, and I just wanted to understand

9:28

how do I keep investing in

9:31

my life insurance plan when well,

9:33

I mean, with this economy and everything going

9:35

on, I really don't know how to maintain

9:38

it. I don't really know what to do now, Doctor

9:41

Lynn.

9:42

You know that. Yeah, that's an excellent

9:44

question. And first of all, you know my prayers

9:47

are with you as you figure out how to regroup.

9:51

The number two thing and the overall financial

9:53

strategy is to get more money,

9:55

build multiple streams of income, and

9:57

so to that piece of it, I would say, start

10:00

right now thinking about what you can do.

10:02

Start your own business, your own home based

10:04

business, because one stream of income

10:07

has haasing to your wealth. And one

10:09

of the things I often say, it doesn't

10:11

matter if you're a doctor, a lawyer, or a teacher,

10:13

you can still be an entrepreneur. A doctor

10:16

can teach health classes

10:18

and tutor and things like that. A lawyer

10:20

can also teach legal clinics

10:23

and teach people how not to get shot if they

10:25

get pulled over. A teacher can

10:27

set up tutoring and so depending on what

10:29

your skill set is, whether it's your professional skill

10:31

set and or something

10:34

that you have passion about or that you are

10:36

or that you enjoy doing, you set up another

10:38

stream of income in terms of your life

10:40

insurance. You just hit a very key

10:42

point. It is important for every

10:45

single one of us, and I'm saying everybody.

10:47

I don't care how many jobs you have. It

10:50

is important for you to have your own life

10:53

insurance policy independence

10:55

of your job, because if you lose

10:57

your job, you will also lose

11:00

that life insurance. And by the time you

11:02

lose that job, you may be older.

11:04

You will be older. I mean even if it's

11:06

just one day, you'll be older, and

11:09

you may not be in the best health

11:11

that you were in when you first got the

11:13

job or got the life insurance policy. So

11:15

the number one thing I say to you is

11:18

to remember that the word is here

11:20

is life. This is your life. This

11:23

literally is your life. And

11:25

I'm going to tell you from my own experience,

11:28

it did not matter I was on food fair,

11:31

I was, you know, degreed in

11:34

finance, mathematics, business

11:36

master degree. I had been the vice president

11:39

of a major financial institution,

11:42

and I could not find a job. But let me tell

11:44

you what I had. I had food fair I

11:46

had a roof over my head, and I had some life

11:48

insurance. Because here's what I knew.

11:51

As long as I have a roof over my head and

11:53

I have food on the table, I will not be

11:55

homeless and I will not be hungry. But you

11:57

get me pass those two things. Live

12:00

with my grandmother. Whatever it takes

12:02

to do to get there. Now, I'm gonna

12:04

grind and I'm gonna make sure I hav enough

12:06

life insurance because just in

12:08

case I don't wake up, then

12:10

my children would not feel the fallout

12:13

of my mishap. My children would not feel

12:15

the fallout my community, my generation. Some

12:17

people say, well, I don't have children. Don't

12:19

you care about something? Is there a

12:21

community center you'd like to build in your old

12:23

neighborhood. Is there something you'd like to

12:26

donate to a school? Is there a church,

12:28

is there a center? See what other cultures

12:30

do is they make sure that the next group

12:32

doesn't have to start over. And so my blessings

12:35

and my prayers are with you as you figure

12:37

that out and you find fifty dollars,

12:39

sixty dollars or whatever. It is a month to

12:42

figure out a way to get some life insurance

12:44

and to maintain it.

12:46

Please don't go anywhere. We'll

12:48

be right back with more money Making Conversations

12:50

Masterclass.

12:58

Welcome back to the money Maker Conversations

13:00

Masterclass, hosted by Rashaan McDonald's

13:03

money Making Conversations Masterclass

13:05

continues online at Moneymakingconversations

13:08

dot com and follow money Making Conversations

13:11

Masterclass on Facebook, Twitter, and

13:13

Instagram.

13:15

Great, let me ask you this question because

13:17

you have I'm not trying to

13:19

get into the life insurance expert conversation,

13:22

but there are different versions of life insurance.

13:24

You have the term life that I'm

13:27

fear familar with, then you have whole and universal.

13:30

Are you a verse enough to tell us the difference

13:32

and why once you go with the other

13:34

there?

13:35

Doctor Liam Richardson, Absolutely

13:38

so. In the early days, if

13:40

you're financially, if you're struggling

13:42

financially, if you're trying really hard to make

13:45

ends meet, what I recommend in your early

13:47

days of getting your financial plan in

13:49

order is to get as much term

13:52

life insurance as you can get

13:54

a twenty or thirty year term policy

13:57

that is temporary life insurance. But

14:00

instead of you only having let's say one

14:02

hundred thousand, you may have five hundred thousand

14:04

or a million, particularly if you have children,

14:07

if you have more than one child, if

14:09

you have a parent, a grandparent. You

14:12

see what, Sean, I had enough life insurance

14:14

not just to take care of my children, but

14:16

my grandmother raised me. You heard me talk about

14:18

grandma to me,

14:21

and if something happened to me, I

14:23

wanted to make sure that there was enough money to

14:25

take care of her, to put her into

14:28

not just a nursing home, but a skilled

14:31

facility that would be able

14:33

to support her comfortably during

14:35

her last days. And so when you get

14:37

the life insurance policy, you also set

14:40

up a trust. The trust explains

14:42

what to do. The trust says, give

14:45

each child tuition money once

14:47

a month, or enough money for rent.

14:50

It says, pay grandma's nursing

14:52

home bill, or whatever it does. Because what we don't

14:55

want to do is leave this money for people

14:57

to just mess it up, right, because we have to know that

15:00

dig and kill everybody. That's

15:04

just you know, because that's how we think you're

15:06

thinking. Well, I don't want to just leave it to them because

15:08

then they're going to mess it up, and so we don't do anything.

15:11

No, A trust is a business

15:13

plan for what happens to your money and to your

15:15

assets after you die. So that's

15:17

term life. As you get a little

15:19

more seasoned, you may want to convert

15:22

some of your insurance to whole life. Whole

15:24

life is life insurance that will last

15:27

you a lifetime. You may have to pay

15:30

it until you're sixty five years old, but

15:32

you may pay it until you're seventy five or whatever

15:34

your particular contract says.

15:36

But then that life insurance is in

15:39

place until you pass

15:41

on. And the good thing about whole life

15:43

Rashaan is it's an automatic,

15:45

built in savings plan. If

15:48

you find yourself in a situation

15:50

where you need money to buy a house,

15:53

to handle an emergency to live

15:55

off of, you can pull down the money

15:57

that has been placed into the whole

16:00

life saving portions and then finally,

16:02

universal There are many different ways

16:04

that you can use a universal policy, but

16:07

the number one way is to have it following

16:09

one of the top indexes inducees

16:12

in the stock market. So if you have a

16:14

universal life policy and it is

16:16

outperforming the S and P five hundred.

16:18

Then what you can expect over time is

16:21

that your saving portion will grow,

16:23

just like the stock market. So there are multiple

16:26

ways, but I say to everyone, at

16:28

least get started with an inexpensive

16:30

term policy and then agree

16:34

your policy, you know, as you go along.

16:36

And I would agree, like I said, I've had

16:39

the I have, I've not had I have a

16:41

universal policy, and the interest

16:43

rate has been no lower than four percent

16:46

in the last fifteen years. So

16:48

that means when it was zero or one

16:50

percent or no percent, I've always

16:52

had four percent minimum guaranteed

16:55

on my money that I had in

16:57

my universal a

16:59

whole policy. So she's telling

17:01

the absolutely truth.

17:03

Yeah, and that's about one hundred times

17:05

better than what you're going to get in a safe's account at

17:07

the bank. It's about three times better

17:09

than what you're going to get buying bonds. And

17:12

it's a great, great way to have something

17:14

stable, but also that that's

17:16

growing with the stock market. I love it.

17:18

Yeah.

17:18

And another note she can tell you is that if

17:21

you could actually do a loan against

17:23

the money that you have there, so you actually

17:25

can use your money and not take

17:27

it out, just take a loan against it, and so

17:30

it's just so many ways why this

17:32

is important to have a conversation because we

17:34

as a community have to understand you don't

17:36

have to always you know, you can bar

17:38

against your own money and just keep living

17:40

a great life instead of sitting over there playing high

17:42

interest rate or not being able to

17:45

do anything because you're frustrated because

17:47

you didn't think out the process. By relationship

17:49

with doctor Lynn Richardson goes back over

17:52

ten years fifteen years which

17:54

he was a regular, a regular on

17:57

Steve Harvey's talk show as a financial expert,

18:00

seeing her many times on Good Morning America.

18:02

So you're getting a person who's

18:04

giving advice that's naturally recognized

18:07

and also a voice that cares about the

18:09

community. And that's why it's important

18:11

when she gives this advice that you can hear

18:13

that little extra passion in her

18:15

back.

18:17

Because it's all bit up.

18:18

She's like ready to just just jump

18:20

in and just tell you shake you listen

18:23

to me, you can do this. And

18:25

that's really what drives her, and that's

18:27

what makes me really enjoyed listening

18:29

to you. I just sit back because when

18:32

you when you're in the

18:34

blessed to be a part of something unique, and

18:36

that's when I have these conversations with you, doctor Lynn

18:38

richardson your unique and very special

18:41

talent.

18:42

And what you're doing is just not normal.

18:44

And I really appreciate you coming on the show

18:46

talking like this.

18:48

Wow. Let me tell you when you said,

18:51

it's that little passion like I just want to jump,

18:53

I do. I want to just jump in

18:57

mind and

19:01

just say go. If I had a remote control

19:03

and I could use it to help

19:06

every last one of us make the decisions that

19:08

we need to make to be free, you

19:11

see, Wellshan, this is not just about

19:13

money and what I want people to understand. It's

19:15

about the freedom that

19:17

you have when you have the

19:20

resources to make choices

19:23

that are in alignment with God's will

19:25

and your wishing. It's about freedom.

19:28

Right.

19:28

We got Eric on the line, Eric and from College

19:31

Park. How you doing, Eric, I'm.

19:33

Fine, it's McDonald. I'm glad I caught you. I

19:35

didn't think I would, but I heard doctor

19:37

Lynn Richards from Streak.

19:40

She was talking to me, so I

19:42

had a dollar do.

19:45

Well, what Quesse did.

19:46

You have for the incredible doctor Livitz because

19:49

speak my friends beat well.

19:52

She spoke about the S

19:54

and P and that I could invest, say

19:56

fifty bucks a month or whatever. I

19:59

need to hear that one more.

20:02

Absolutely, Yes, you can choose

20:05

a license a universal whole life

20:07

insurance policy that is

20:10

connected to an index. So

20:12

if you choose a fund, let's

20:15

just say, for example, you have a brokerage

20:17

account at Fidelity or Charles Wyb

20:19

or TVA Marror Trade or each any

20:21

one of them, go into the research

20:24

section and choose

20:26

a fund that outperforms

20:29

the S and P five hundred. So

20:31

if you have a four to oh one K or

20:34

if you have a life insurance policy, then

20:36

you have the ability to invest your money.

20:39

You're gonna see a list of funds.

20:41

Most of us don't know what that list means.

20:44

It may see that it may say the Fidelity fund,

20:46

it may say the Vanguard

20:48

fund, and it'll have three or four

20:51

letters. You take those three

20:53

or four letters, you put them into

20:55

your research box in on

20:57

the website, on your platform,

21:00

and then you compare compare

21:03

to what you compare to the S and

21:05

P five hundred. If your

21:07

fund performs better than the

21:09

S and P five hundred over the past twenty

21:12

years. So I'm not just giving you quick

21:14

advice. Look at what it's done

21:16

over the past twenty years. If that fund

21:18

outperforms the S and P five hundred, what

21:20

it means is it's going to increase

21:23

in value over time. Now

21:26

we're making a decision between two funds.

21:28

Look at both funds and see which one

21:31

perform the best. So that's

21:33

a very simple way for anybody.

21:36

I don't care who you are. You don't have

21:38

to have any investment knowledge to be

21:40

able to decide which fund should

21:42

I choose, Because Rashaan, that's one of the things

21:45

that gets most of us. We don't know what funds

21:47

to choose for our four to one case or

21:49

whole reversal life and so on.

21:51

Yeah, right, wow,

21:54

Eric, you know, just getting that information.

21:57

If there is some work, you gotta go online.

22:00

There's but what she's showing it.

22:02

There's no magic bullet here. The information

22:05

is there. You just have to compare.

22:08

And that's the that's

22:10

the part that really drives us maddening

22:14

and maybe angry because of the

22:16

fact that we are we

22:18

all have cell phones. You know

22:21

that cell phone. Just go to just go to

22:23

a uh, just go to r L you

22:25

can look at it, looks into it. Now because we're in

22:27

a mobile society, so there's no excuse.

22:30

Now, I don't have a computer. I don't have

22:32

a laptop. You have a cell phone, and

22:34

that cell phone allows you to do all

22:36

the research. That cell phone allows you to

22:39

download apps, that cell phone

22:41

allows you to actually run

22:43

your financial enterprise.

22:46

Let's think that big you are a financial

22:48

enterprise. And if you think that way,

22:51

then guess what your mindset would change.

22:53

And that's what Lynd Richardson is telling us. But

22:56

I'm just telling you the excuse of the

22:58

old days out of I

23:00

don't have the technology to compete.

23:02

I don't have the ability to do the research.

23:05

Yes you do.

23:06

If you called me on your mobile phone, if

23:08

you listening to me on your mobi phone,

23:10

if you use your mobile phone, you have the

23:12

ability to compete. There

23:14

are no excuses. Do what she's

23:17

asking. All she's doing is asking the

23:19

listeners, asking you eric to do this.

23:21

Okay,

23:24

this is so in.

23:26

Most of the time, when people ask

23:28

me a question, I give them

23:30

a class and people say, well,

23:32

ma'am, why can't you just answer the question? Rashaun,

23:35

you know, there's no such thing as just answering the

23:37

questions. You have to learn how

23:39

to get your money straight, and

23:41

then you have to learn how to keep your money

23:43

straight? Okay, because more money

23:46

doesn't solve a money problem. If it did, millionaires

23:48

would go bankrupt. There are too many

23:50

stories of people who get money and they'll lose

23:52

it because they did not do the work to get it,

23:55

nor did they do the work to keep it. So

23:57

education is the key and need

24:00

to move from knowledge to action because

24:03

knowledge is not power. People say

24:05

knowledge is power. No, knowledge is not power

24:07

until it is put into action.

24:11

Whoo you

24:13

are?

24:14

How do okay? They listened

24:16

to you on my show once a quarter?

24:19

How can they reach out to you? Do you have a website?

24:21

How what's your social media? Because

24:24

your information is sustainable

24:27

and they need to know how to reach out to you. Got one minute

24:29

left filling in on all the closing details

24:32

about how they can reach out to doctor Lynn

24:34

Richardson and what format you have available

24:37

to change their lives.

24:39

Well, first of all, I'm more than happy to come back

24:41

as much as you like, so we could turn once a quarter

24:44

to once a month. That's

24:48

number one. Number two, Ask

24:50

linn dot org. Go to ask Lynn

24:53

a s k o y n n no ea

24:55

dot org. Submit your question,

24:58

you get an immediate reply, and then follow

25:00

me on social media at Lynn Richardson. If

25:02

you want to boatload of knowledge and education,

25:05

go to my YouTube page which is Leonardson dot

25:07

tv. But asplan dot org

25:09

is the gateway to your freedom.

25:12

My friend again, you're

25:14

so special, You're such a you know, it's

25:17

always you know, I've done a lot of

25:19

good things in my life.

25:21

Borr.

25:21

When you come on.

25:22

My show, you have me fired

25:24

up, you have me thinking all the right things.

25:26

But more important, you change people's lives. We'll

25:28

talk soon again. This is doctor

25:30

Lynn Richardson. She's blessed us

25:32

with another another great.

25:34

Episode on Money Making Conversation Masterclass.

25:39

Thank you for joining us for this edition of

25:42

Money Making Conversations Masterclass.

25:44

Money Making Conversations Masterclass

25:47

with through Sean McDonald is produced by

25:49

thirty eight to fifteen Media Inc. More

25:51

information about thirty eight to fifteen

25:53

Media Inc. Is available at thirty

25:55

eight to fifteen media dot com.

25:58

And always remember to lead with

26:00

your gifts.

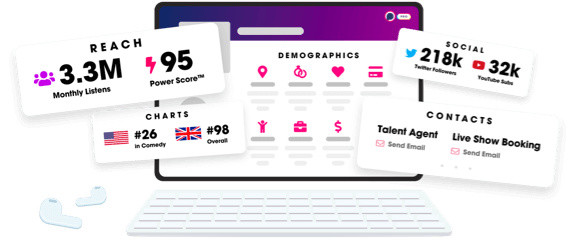

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us